The Advancement in technology and online payment transaction has offered an immense amount of convenience to both consumers and businesses. The ease and widespread acceptance of online payment including the credit/debit card transaction has streamlined business processes and payment transactions greatly. Globally, it was observed that credit card transactions increased by roughly 6% between 2020 and 2019, and roughly 188 billion purchase transactions were made worldwide using Visa payment cards in 2020 (an increase by 1.3%).

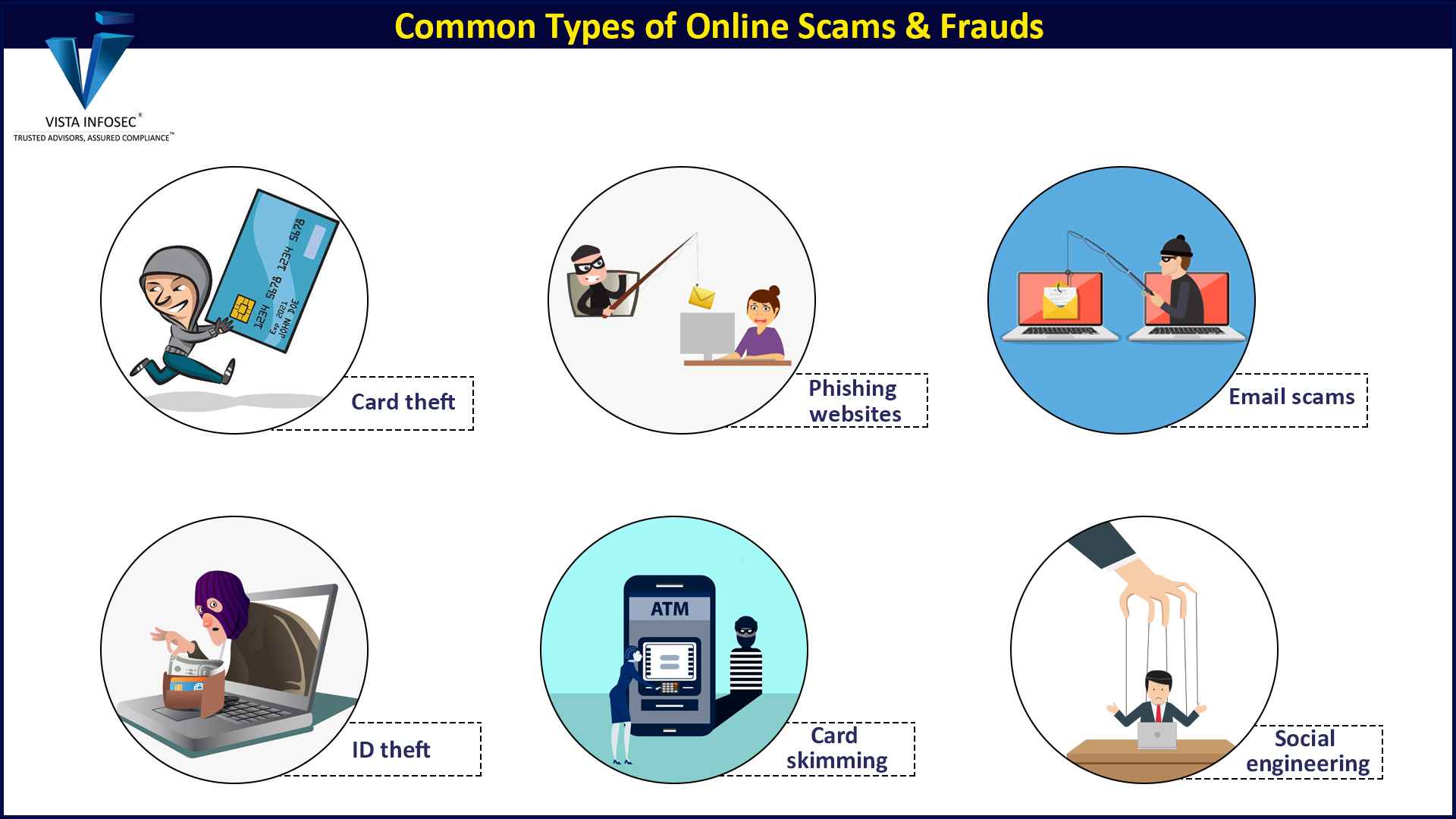

Further, the number of payment cards in circulation worldwide grew by over two billion between 2019 and 2021 and is forecast to further increase. However, with such progress in online payment transactions, it has also increased the incidents and cases of scams, frauds, and cyber-attacks.

Since the boom of the online payment industry, it has become an easy and soft target for attackers. Payment methods such as credit/debit card transactions are a huge target for hackers to perform their malicious crimes. This has in turn compelled businesses and industry regulators to establish stringent standards and frameworks that ensure the security and privacy of sensitive data and assets.

Global Statistics of Payment Card Fraud (2020-2021)

- Payment card fraud losses worldwide exceeded $32 billion in 2021, of which nearly $12 billion was in the US.

- Losses to fraud worldwide increased by 14% in 2021.

- Over the next 10 years, the industry is projected to lose an accumulated $397 billion worldwide, with $165 billion coming from the US

- The US accounted for 37% of worldwide losses to card fraud in 2021.

- Card fraud netted criminals nearly $4 billion more in 2021 than in 2020.

- Issuers, merchants, and acquirers of merchant and ATM transactions collectively lost $28.58 billion to card fraud in 2020.

Advent of PCI DSS Standard

In order to effectively address credit card fraud, payment card brands such as Visa and MasterCard first created a security program for their credit cards ( Visa introduced their Visa Cardholder Information Security Program and MasterCard introduced their MasterCard’s Site Data Protection). Similarly, other payment brands followed the suit and introduced such security programs for their credit cards.

Such security programs were introduced with the aim to protect card issuers and cardholders against various credit card frauds. However, this made it confusing for Merchants and Service Providers to meet the requirements of multiple payment brands. The challenge of not having a uniform security standard and approach to security requirements resulted in merchants struggling to meet the compliance requirement of various payment card brands.

This is when major payment brands like Visa, Mastercard, American Express, Discover Financial Services, and JCB International came together to establish a uniform payment security standard. The initiative of creating a uniform security payment standard was to standardize and regulate card transactions and processing among all merchants and service providers. These 5 major payment brands came together and formed a Payment Card Industry Security Standard Council (PCI SSC) and further established the Payment Card Industry Data Security Standard (PCI DSS).

PCI DSS Standard

PCI DSS Standard was first introduced in the year 2004, thereafter we have seen the standard constantly evolving over the years, till the recent version which is the PCI DSS 4.0 which was updated in the year 2022. The industry has constantly witnessed the evolution of this international payment security standard to keep up with the evolving and sophisticated threat landscape. The latest version was introduced to enhance the security of payment card account data and also deal with evolving and emerging security threats.

PCI DSS is a benchmark standard for all merchants and service providers to meet the technical security requirements for protecting sensitive account data. The latest version of PCI DSS 4.0v provides guidance and flexibility in the implementation of high-level security measures while also allowing customization in the implementation of security solutions. This is to meet the industry’s best security standard requirements and attain a maximum level of security for payment card account data.

PCI DSS Standard is a comprehensive set of high-level security rules and requirements. It is defined and established to ensure and maintain a maximum level of security by merchants and service providers in the payment card industry. The standard is a mandate for all Merchants and Service Providers who process and store cardholder data. They are expected to meet the industry’s best practices and follow the set of rules and guidelines of PCI DSS in order to work and be a part of the payment card industry. Every business dealing with payment card data is accountable and obliged to meet the standard requirements and further verify this with a Qualified Security Assessor (QSA) whether or not the business is compliant. Further, businesses are expected to undergo an audit every year in order to attain the certification of Compliance with PCI DSS.

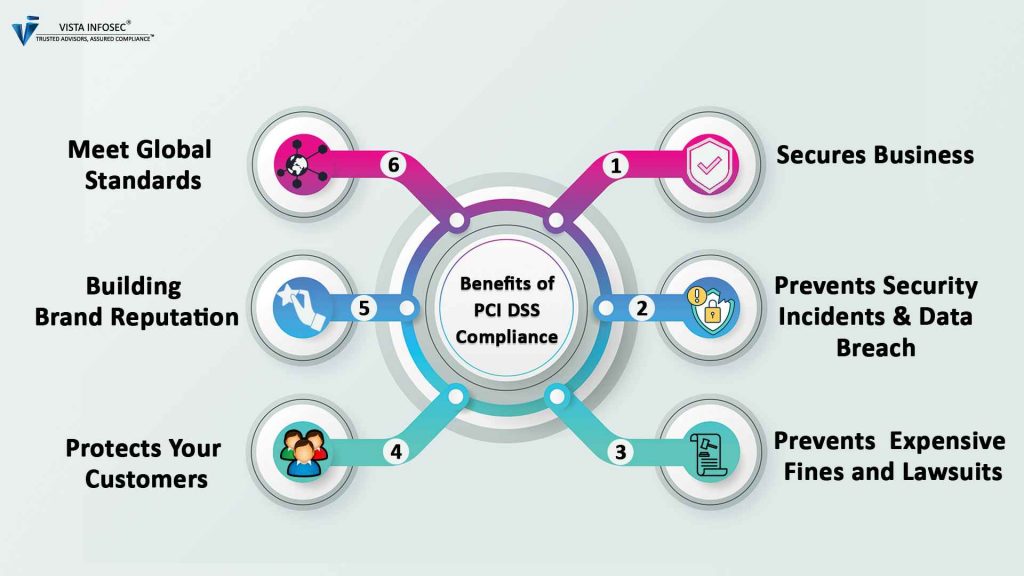

Failure to comply with the standard can have significant implications in terms of hefty penalties, lawsuits, payment brands placing restrictions on card processing, losing license of payment brands with complete termination of services, and tarnished brand reputation. Due to such obligations and significant repercussions, businesses are bound to prioritize security in their business operations and processes.

This in turn helps businesses build a shield against the evolving security threats and risks of data breaches and cybercrimes in the payment industry. Ultimately the whole purpose of PCI DSS is to protect card data from hackers and thieves. By following the standard, businesses can keep the data secure, and prevent a data breach. This way, the level of accountability established in the industry, helps in keeping the checks and balances in place when it comes to implementing and ensuring safe payment transactions in the industry.

Conclusion

PCI DSS may not seem necessary as it isn’t a mandate by law. Yet it is important to comply with the standard, in order to ensure secure business and safe payment transactions. PCI DSS is an industry best security practice that must be followed if you are a business handling sensitive and valuable payment card information of customers.

This is because even a single incident of a data breach will have repercussions beyond just simple theft. So, taking that extra time and effort to make sure your business is complying with the PCI DSS standard is important. By doing so, you are not just protecting your business but also acting responsibly and protecting your client as well.

So, we strongly recommend businesses aim for PCI DSS Compliance if they are a part of the payment card industry and the standard applies to their business. You can always consult our compliance expert at VISTA InfoSec for assistance and guidance in achieving PCI DSS Compliance. We are a qualified PCI QSA, PCI QPA & PCI SSFA, having the industry knowledge and expertise in PCI DSS Compliance & Audit.