As your organization undergoes more and more digital transformation, employees and users alike require continued access to essential data. Business partners, remote workers, and online visitors are some of the people to name a few. Although this digital transformation has made things easier for customers and boosted revenue, it also makes your data vulnerable.

The number of data breaches rose from 22% in 2020 to 36% in 2021. That is why, to prevent unauthorized access to sensitive data, effective authentication for identity verification is essential. Risk-based authentication, often known as adaptive authentication, is a new identity and access management system. It determines whether a user is possibly dangerous, based on a variety of characteristics. This includes determining their behavior, the gadgets they use, and other parameters.

Businesses are just as responsible for safeguarding their customer’s data as they are for safeguarding their own personnel and processes. It is critical to use the correct supplementary authentication solutions for cybersecurity to protect this and adhere to safety laws. In this article, we will talk about what is risk-based authentication. We will also discuss how it can help your business secure its data and prevent cyber attacks.

What is Risk-Based Authentication?

Risk-based authentication is an invariable identification system. It evaluates the characteristics of a customer wanting access to the network to establish the risk profile related to that activity. These include a user’s IP address, physical location, browser history, and several more. It uses these criteria to assess the risk associated with the profile. The system is designed in a way that it asks for extra credentials only at a certain risk level, thanks to the risk-based implementation.

As the name suggests, an adaptive authentication system is dynamic, unlike traditional ones. It is basically a user or transaction-dependent system. In a user-based authentication system, a specific identification process initiates for a specific user. On the other hand, in transaction-based authentication, the whole process depends on the risk level of a given transaction.

The user’s geolocation and IP address, access device, frequency of login tries, and behavioral factors like how fast they type and if they are acting unusually, are all common parameters for risk assessment. The best option for businesses to protect consumer data is to use risk-based authentication. It uses behavioral biometrics as a criterion for risk assessment. It also provides optimum security with the least amount of disruption to the user’s experience.

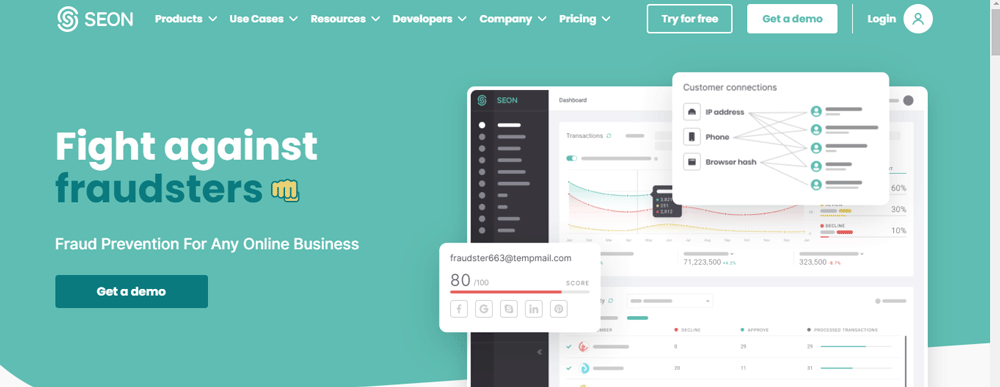

However, you don’t need to hire a programmer and create a brand new authentication system for your business. There are several tools available online that do the work for you.

Such tools and software analyses a client’s digital footprint by verifying whether a phone number is genuine, detecting dubious free domains and the device they use to access your website. An excellent example is a valid customer entering into a banking site using their usual browser. They use a verified personal device that has been recognized by the bank. The algorithm concludes that the danger of theft is so negligible in this scenario that they don’t have to re-authenticate after logging in.

Extra authentication difficulties are only implemented when a customer’s behavior differs from typical (such as using a different device or browser.) This leads to higher security barriers for riskier activities like bank transactions. The customer is asked to confirm themselves in one of several ways. If they do so successfully, they are directed to the appropriate portal.

How Can Risk-Based Authentication Help Your Business

1.Enhance User Experience

Fraud is on the rise, necessitating the implementation of more robust security and authentication solutions. Customers, on the other hand, demand a frictionless experience. They have little patience for sophisticated security procedures. If there are too many authentication layers, users will be put off by the extra processes. Security solutions must be robust while also being simple to use. Moreover, enhanced customer loyalty and retention will promote growth through a seamless user experience.

Risk-based authentication is a fantastic approach since it adds security while maintaining a smooth flow of interactions. Only suspect transactions would require additional layers of authentication, thanks to machine learning and personalized rules, giving users the least intrusive experience possible.

2.Increase defense against cyberattacks

Contemporary fraud techniques are becoming more sophisticated. So much so that a password, no matter how secure, isn’t enough to keep fraudsters out. Permanent passwords are easy to crack and are a major source of data leaks. Users, on the other hand, are irritated by many tiers of verification.

In December 2014, employees at Yahoo discovered that Russian hackers had gained access to nearly 500 million user accounts. The gravity of the situation escalated to the next level when it was discovered in July 2016, that the entire websites’ data had been stolen.

Utilizing risk-based authentication allows for a tiered, flexible approach. Good RBA systems look at data from several sources and make real-time judgments about which degree of authentication is best for each transaction. To determine the risk level, these systems use artificial intelligence to create an overall context-specific perspective. It combines behavioral, transactional, and device-specific data to do so.

3.Keep abreast with the regulations

Banking regulations are always changing and growing more intricate and extensive as fraud methods evolve and become more sophisticated. They assist firms in staying ahead of hackers, but they might be difficult to keep up with.

Your company must be flexible and adaptive to comply with all requirements as they evolve and become more extensive. Additionally, you must implement new security procedures regularly. It will save a substantial amount of time in testing and implementation if you have a risk-based authentication system. It employs machine learning to better detect and battle fraud, along with bespoke rule sets designed to quickly handle compliance needs. As a result, while Multi-factor Authentication provides a high level of protection, it lacks a good user interface and frustrates customers as they try to go through all those layers. Risk-based authentication is an excellent answer to this problem.

Wrapping Up

Keeping your clients and your data safe must be your top priority. In the age of ‘innovative’ methods of cybercrimes, outdated authentication like passwords might not work. A natural next step in managing user data and information confidentiality in real-time is risk-based authentication (RBA). To improve RBA efficacy, companies will keep offering new integrated authentication methods and use AI techniques. Although it is not the ultimate solution to identity verification, It is a great step forward to protect sensitive data.