Since the onset of the pandemic in 2020, global concern for data security and privacy has skyrocketed like a dazzling display of fireworks on New Year’s Eve. With an ever-increasing number of people utilizing online services and sharing their personal information on websites to engage in e-commerce transactions, the infrastructure for collecting and safeguarding consumer data has become of paramount importance.

A study by CYTRIO revealed that a staggering 95% of companies required to comply with GDPR were either partially compliant or non-compliant with its requirements. This could have grave repercussions for these companies, as non-compliance with GDPR can result in hefty fines and other penalties.

The GDPR is a privacy regulation law mandated by the EU that applies to any organization handling data on EU citizens, regardless of where the organization is located. This means that even if you are a merchant who is compliant with PCI DSS and has just one EU customer, you must comply with the GDPR.

While being compliant with PCI DSS may provide some measures that can help achieve GDPR compliance, it does not necessarily mean that a company is also compliant with the GDPR. This is because there are differences between the two standards, despite some overlap.

A Research in 2022 by PSR indicates that only 43.4% of organizations were fully PCI DSS compliant in 2020. The escalating threat of data breaches and cyberattacks underscores the critical importance of compliance. Failure to comply can result in fines, damage to an organization’s reputation, and loss of customers.

Like two sides of a gleaming coin, the GDPR and PCI DSS have played pivotal roles in elevating public consciousness about the importance of data privacy and security. But what distinguishes these two standards and what commonalities do they share? Without further delay, let us delve into the similarities between them and gain a clearer understanding of why compliance with both GDPR and PCI DSS is essential.

Impact and Changes: The Evolution of GDPR and PCI DSS

The General Data Protection Regulation (GDPR), a privacy protection law for EU citizens adopted in 2016 and implemented in May 2018, has had a profound impact on the privacy landscape over the past five years.

Like a shining beacon of hope, the GDPR has inspired the enactment of privacy laws in over 100 countries, including Brazil’s LGPD and American state-level laws such as CCPA or CPRA and VCDPA.

These laws are founded on the GDPR’s core principles, which emphasize individual privacy rights and the necessity for companies to be transparent about their data collection and usage practices.

In contrast, the Payment Card Industry Data Security Standard (PCI DSS) was first introduced in December 2004 by the PCI Security Standards Council (PCI SSC), an independent body composed of MasterCard, Visa, American Express, JCB, and Discover.

It was established to enhance control over cardholder data and reduce credit card fraud. Over the past two decades, the PCI DSS standard has undergone several revisions to address emerging risks and threats.

The most recent version, PCI DSS v4.0, was released in March 2022 and effectively addresses emerging threats and technologies while providing innovative ways to combat new challenges.

The Scope of PCI DSS and GDPR:

When it comes to understanding the differences between the PCI DSS and the GDPR, one of the most important aspects to consider is their scope. The scope of these two compliance frameworks refers to the type of data they cover and the organizations they apply to.

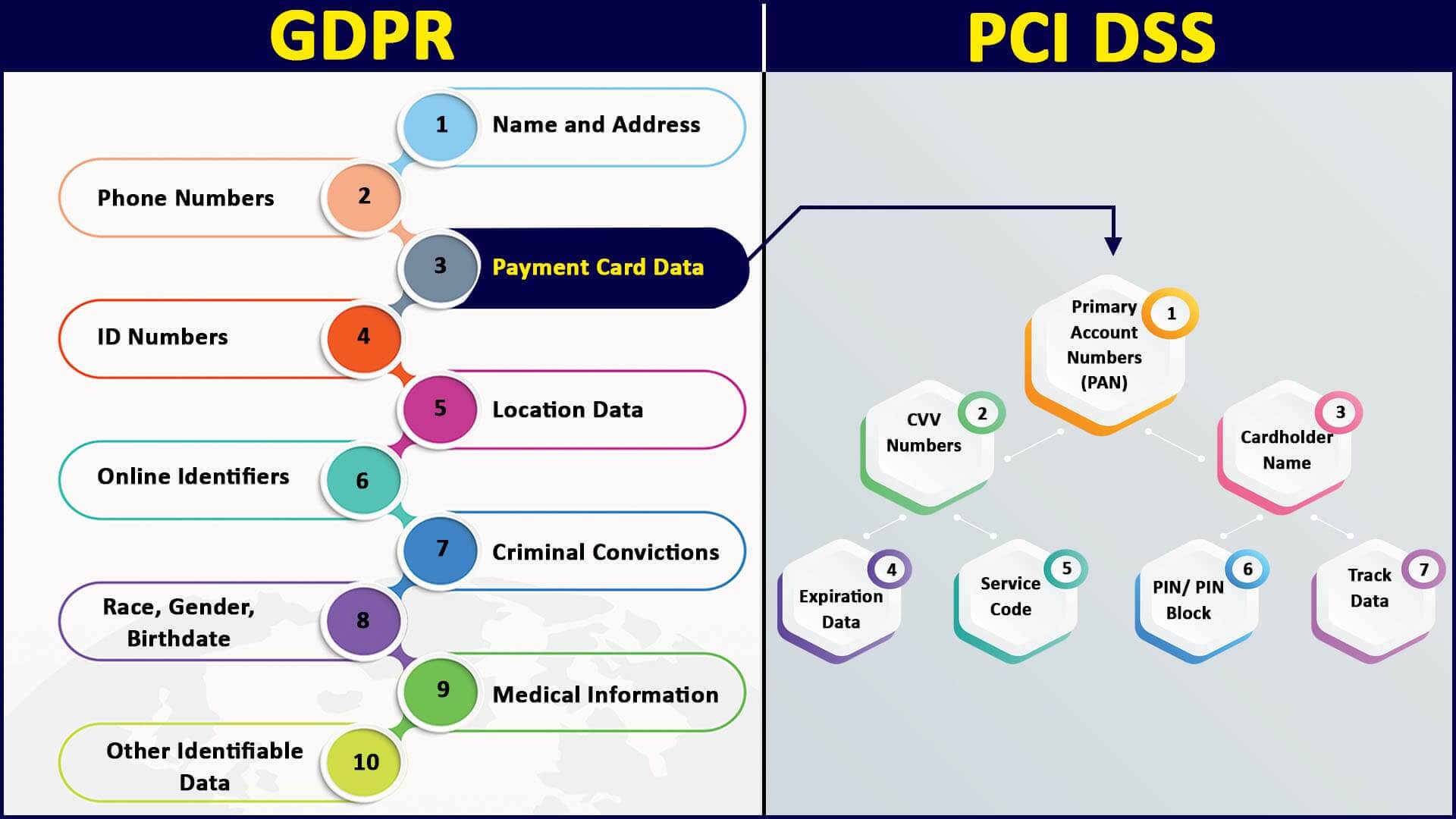

In terms of scope, GDPR is much broader than PCI DSS. This is because GDPR encompasses all personally identifiable information (PII) of individuals located in the European Union. This means that any organization that processes or stores personal data of EU residents must comply with GDPR, regardless of where the organization is located. The type of data covered by GDPR includes a wide range of information that can be used to identify an individual, such as their name, home address, photo, email address, bank details, medical information, posts on social networking websites, or a computer’s IP address.

In contrast, PCI DSS has a much narrower scope. It applies specifically to organizations that process or store payment card data. This includes credit/debit card numbers, primary account numbers (PAN) (Requirement 3.3), and sensitive authentication data (SAD) such as CVVs and magnetic stripe data from all major card schemes (Requirement 3.2).

While cardholder data is still considered PII, it represents just a small portion of all the personal data covered by GDPR. The differences in scope between PCI DSS and GDPR have important implications for organizations that process or store personal data.

For example, if a business takes credit cards and some of those credit cards belong to EU citizens, then the business must comply with GDPR in addition to PCI DSS. This means that businesses must carefully consider the type of data they are processing or storing in order to determine which compliance frameworks apply.

Law and Standard Enforcement:

Protecting sensitive data and ensuring the privacy of customers is of utmost importance for businesses. To achieve this, compliance with both the GDPR and PCI DSS is essential.

As we know, GDPR is a law that applies to all organizations that process or store personal data of individuals located in the European Union. It sets out strict requirements for the protection of personal data and imposes significant penalties for noncompliance.

On the other hand, PCI DSS is an industry standard enforced by the card brands that aims to secure payment transactions and protect cardholders against the misuse of their personal information.

While the PCI Security Standards Council (PCI SSC) does not have legal authority to impose fines on businesses that are not compliant with the industry standards, noncompliance with PCI DSS can still have costly consequences.

If a merchant suffers a data breach and is found to be noncompliant with PCI DSS, the payment card brands can impose penalties on the merchant’s acquiring bank.

These penalties can range from $5,000 to $500,000 per month and are typically passed along to the merchant by the bank. In cases of repeat offenses, the payment card brands can even revoke the rights of the merchant to process transactions using their cards.

In short, compliance with both GDPR and PCI DSS is essential for businesses that want to protect sensitive data and ensure the privacy of their customers. Noncompliance can have serious consequences, including costly penalties and loss of the ability to process payment card transactions. By adhering to these frameworks, businesses can demonstrate their commitment to data protection and privacy, and build trust with their customers.

Comparing Data Breach Disclosure Requirements:

The GDPR and the PCI DSS have distinct differences in their data breach disclosure demands.

Under the GDPR guidelines, data controllers must dutifully declare any data breaches to the designated supervisory authorities within a deadline of 72 hours after discovering the incident.

In contrast, PCI DSS does not demand that organizations disclose data breaches to either the public or the PCI SSC.

Nevertheless, organizations are obligated to inform their payment processor of any data breaches under PCI DSS. The payment processor then passes on this pertinent information to the card companies. Often, organizations only become aware of a data breach when they are alerted by the card companies.

In the United States, there is no uniform, nationwide data breach notification regulation. Instead, a patchwork of state-level requirements exists, with each state setting its own standards and stipulations for reporting data breaches.

Safeguarding Sensitive Data:

The GDPR and the PCI DSS both play pivotal roles in preserving private information.GDPR’s primary purpose is to protect the privacy of data subjects by preventing the misuse of their personal data.

- This is accomplished by empowering individuals to take charge of their own data and providing them with specific statutory safeguards.

- Organizations must furnish EU citizens with the facilities to exercise their rights under GDPR.

These rights include:

-

- Accessing their personal data.

- Having their personal data corrected or expunged.

- Restricting the processing of their personal data.

- Objecting to the processing of their personal data.

- Transferring their personal data to another organization.

In contrast, PCI DSS’s main mission is to secure cardholder data from hackers and cybercriminals and maintain the safety of the entire payments ecosystem.

- This data security standard was initiated by major card brands in 2006 and focuses on daily data defense practices such as firewall fortification (Requirement 1), encryption (Requirement 3.2), and anti-virus measures (Requirement 5).

- By implementing these measures, PCI DSS helps protect sensitive cardholder data and prevent pernicious data breaches.

Future-proofing Data Security:

Businesses often seek ways to streamline their efforts towards GDPR and PCI DSS compliance due to their complexity and cost. One approach is to treat all PII as toxic and minimize the amount of sensitive data within the network.

- For instance, enterprises with contact centers that take payments over the phone can use descoping technologies like Dual Tone Multi Frequency (DTMF) masking solutions.

- These solutions capture payment card information as customers enter it into their telephone keypad, masking the keypad tones so they are indecipherable.

- This prevents the card information from being captured on call recording systems or heard by CSRs.

- The segregated data is then securely routed directly to the payment processor, bypassing the contact center’s IT systems entirely.

- This reduces the scope of compliance for PCI DSS and GDPR, and makes the company a less attractive target for hackers and fraudsters.

Many processes and controls for PCI DSS compliance can also help with GDPR compliance. However, GDPR goes further by making privacy and consent cornerstones in the relationship between a business and its customers. Companies will need to appoint a Data Protection Officer (DPO), assess what data they hold and review consents for that data to be GDPR compliant. But if they are already PCI DSS compliant, there should be no need to completely reinvent their approach to data security.

As more countries and regions pass data privacy regulations similar to GDPR, it is beneficial for organizations to adopt the practices necessary for compliance now.

This will lay the foundation for an easier and less costly compliance experience in the future and help organizations have stronger data security.

Leveraging PCI DSS Compliance to Achieve GDPR Compliance:

As we come to the end of this blog post, we have explored the similarities and differences between GDPR and PCI DSS and gained a deeper understanding of how compliance with both standards can help organizations protect sensitive data. Now, let’s take a closer look at how organizations can combine the requirements of both standards to achieve even greater data security.

Organizations can leverage their existing compliance measures to combine the requirements of both GDPR and PCI DSS.

Both GDPR and PCI DSS prioritize the utmost protection of data, demanding robust security measures. Let’s explore some practical examples of security measures that organizations can adopt to comply with these standards and safeguard their valuable information.

-

Encryption and Tokenization:

Encryption and tokenization are two powerful techniques that ensure data remains secure. Encryption transforms data into a secret code, rendering it inaccessible to unauthorized individuals. On the other hand, tokenization replaces sensitive data with harmless equivalents known as tokens, effectively shielding the original information. By employing these techniques, organizations can ensure that their data remains safe from prying eyes throughout its lifecycle.

-

Data Risk and Impact Assessments:

Another critical aspect shared by GDPR and PCI DSS is the importance of conducting data risk and impact assessments. These assessments involve thoroughly evaluating potential risks associated with processing sensitive data. By regularly performing such assessments, organizations gain valuable insights into where their sensitive data is stored and can take proactive steps to fortify its protection. It’s akin to knowing the weak spots in a fortress and reinforcing them to keep intruders at bay.

-

Leveraging Existing PCI DSS Compliance Measures:

Interestingly, existing PCI DSS compliance measures can play a significant role in demonstrating GDPR compliance as well. Suppose an organization has already implemented robust data security policies to meet the requirements of PCI DSS. In that case, these policies can serve as a solid foundation for showcasing compliance with GDPR’s stringent data security mandates. The good news is that achieving compliance with both standards can be more manageable and less overwhelming than one might initially expect.

By implementing the right security measures, such as encryption and tokenization, and conducting regular risk assessments, organizations can demonstrate their commitment to protecting data. Leveraging existing PCI DSS compliance efforts not only strengthens data security but also streamlines the path toward GDPR compliance. Remember, safeguarding sensitive information is not only an obligation but also an opportunity to earn trust and maintain the integrity of your organization.

This means that achieving compliance with both standards can be easier than you might think.

If you’re interested in learning more about how leveraging PCI DSS compliance can help you achieve GDPR compliance, be sure to check out our blog on, How Achieving Compliance with PCI DSS Can Help Meet GDPR Mandates for more information and insights.

Conclusion:

Thank you for reading our blog post! We hope you found it informative and engaging. What are your thoughts on data privacy and security standards in GDPR and PCI DSS? If you have any questions related to this blog, please let us know in the comments. At VISTA InfoSec, we are a global security consultant firm that can help your business achieve compliance with GDPR and PCI DSS, setting you up for future success. Don’t forget to check out our YouTube channel for in-depth knowledge on PCI DSS, GDPR, and other security frameworks. Visit our website to learn more!